Restaurants like the Grain chain are employing more tech to track cost, sales and profitabilty so they can adjust more quickly to changes. Photo by Alessandra Nicole.

Lee Mikles has a dizzying list of what he thinks about every day.

The co-founder of OMG Hospitality restaurant group is focusing on the April launch of a new Grain menu that leans into comfort food that reminds guests of their childhood memories.

He’s also trying to pay more attention to the costs of food and labor while preserving the customer experience.

Some of that is everyday restaurateur mental work.

Lee Mikles

Some of that is new, created during the COVID-19 pandemic, which interrupted and changed a lot of the ways restaurants and customers interact.

For example, Mikles frets about losing control over delivery services that may not drop off food for 30 to 45 minutes after it’s plated.

“With delivery, you get fed, but that’s not our brand so we keep looking for better ways to do things,” says Mikles.

He and partner Jim O’Donoghue opened their first of six Grain restaurants – four of them in New Castle County — nine years ago.

“We don’t want to lose who we are,: Mikles said, “and we hope that our guests understand some of the decisions we have to make.”

Grain made the tough decision in the wake of decreased late-night traffic to start music earlier and reduce weekday hours. By state law, the kitchen must stay open when the bar is up and running.

The good news is they’re starting to see the bar area get more crowded.

Down in Sussex County, the two Dogfish Head restaurants in Rehoboth Beach test what customers want in a post-pandemic environment, including the impact of amping up music programs on attracting new guests and keeping them coming back.

“We’ve revamped our monthly beer dinners, moving them to the mezzanine of the restaurant,” said Operating Manager Ryan Schwamberger, who oversees both Brewings & Eats and Chesapeake & Maine. “We wanted to give folks the chance to chat with our chefs and delve into the stories behind each food and beverage pairing.”

SoDel Concepts President Mike Dickinson said restaurants like his 12 coastal locations have different tools in their toolboxes to “figure out the best way for our individual businesses to deliver the best and most consistent experience to the guests that come through the doors day in and day out.”

SoDel Concepts President Mike Dickinson said restaurants like his 12 coastal locations use different tools to ‘figure out the best way for our individual businesses to deliver the best and most consistent experience’ every day. Photo by Maria DeForrest

Restaurant report

The National Restaurant Association’s 2024 State of the Restaurant Industry Report forecasts restaurant sales to exceed $1.1 trillion for 2024.

It’s a new record for an industry predicted to employ over 15.7 million people this year.

The report also highlights the challenges for the business, including profitability margins.

Average food costs have increased more than 20% since 2019; average wages are up 30%; and 70% of restaurant owners say they have job openings that are difficult to fill.

Mikles agrees that profitability is top of mind.

At Grain, he looks at each menu item on a quadrant with sales on one axis and profitability on the other, and he’s invested in tools to help assess his costs.

“The cost of inputs drives the outputs,” he said. “We have to look at where we can pay for the experience when historically higher-profit items give way to less-profitable choices. That’s why you have to consider raising the price of soda or charging for extra blue cheese in the face of more people ordering water and beer.”

SoDel’s Dickinson welcomes the predictability that his coastal restaurant group saw in 2023 after the rollercoaster it saw from 2020 to 2023 because it brings the ability to control expenses.

“If we know we’re going to do between 95-105 dinners in a night, we can staff, purchase and prep for it,” he said. “With a larger range comes more room for error, whether that be food costs, staffing costs, utility costs, or yo-yoing product availability.”

But, he added, “Restaurants are by their nature counter punchers, so we are constantly adapting to the world around us. Sometimes that means shrinking our main menu and utilizing daily features more. Sometimes that means holding guests at the door for a couple minutes so that servers can get caught up or choosing to close a section or even the restaurant for a night or two a week.”

In her annual letter to Delaware Restaurant Association members, President and CEO Carrie Leishman wrote about dramatic shifts in employee/employer sentiment (including concerns that while pre-pandemic staffing levels have recovered, the quality of the workers may not have and managers may be “disengaged, burned out and job hunting” out of concern that “their organizations don’t care about their well-being”).

“No other industry embraces agility and resilience like the restaurant industry and the future of work isn’t just about technological advances, but is also about creating a culture that values versatility, inclusivity, mental well-being and innovative thinking” she wrote.

Some of the critical skills she highlighted can’t be automated, such as creativity, complex problem solving, and emotional intelligence.

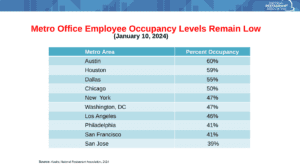

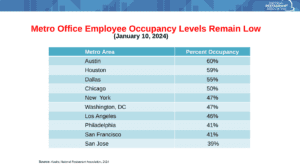

Karen Stauffer, senior director of communication & strategy for the state Restaurant Association, pointed to the plight of downtown restaurants across the country challenged by the slide in city/downtown occupancy rates and corporate work from home programs.

“It paints such a vivid picture of how business is different now vs. 2020,” she said. “Without a rebound of downtown business/people coming back to offices, everything is off — from lunch traffic to morning coffee, happy hours, and business dinners. Wilmington mirrors Philadelphia in this.”

Stauffer added that while labor is always a big concern, it’s become more about attracting and retaining skilled labor than it is just filling positions, and building purpose-driven cultures.

“Do employees share/buy into a company’s vision? Do they truly embrace DEI, and is the workplace psychologically safe — a place where employees feel safe about the future of their role, valued and where they can offer insight and feedback? That’s the new culture,” she asked.

IN THE NEWS: Delaware won’t have a presidential primary this year

Stauffer said sharp decreases in the number of restaurant workers quitting their jobs since the pandemic may be a sign of improvements in benefits and working conditions inside restaurants.

“Operators, fretting their turnover rates, have invested in technology designed to improve the lives of workers,” she said. “They’ve also invested in benefits to keep people around, such as paid time off, retirement benefits, tuition reimbursement and other perks.”

Mikles’ tech that tracks food cost, portion size, profitability and more because of the price of food and labor is an example of that.

“It is better than it was two years ago,” said Hudson Riehle, senior vice president of the national Restaurant Association’s research and knowledge group. “But it’s still the No. 1 ranked priority for operators.”

Leishman agrees: “Pandemic-era courtesy is officially over and reasonable or not, consumers expect that restaurants have largely solved their supply chain, service and staffing challenges.”

Share this Post