A state finance committee said Delaware’s revenues are expected to plateau for fiscal year 2025 and 2026. Photy by Pixabay.

Delaware can expect a revenue surplus of $364.8 million heading into the 2025 fiscal year.

It can also expect a few years of plateaued revenues instead of the nearly $1 billion surpluses of recent years.

Some legislators would argue the state doesn’t have surplus in reality, because that money will be needed for expected rises in costs for a number of programs, including health insurance for employees, scheduled employee salary raises, high pension costs and higher Medicaid costs.

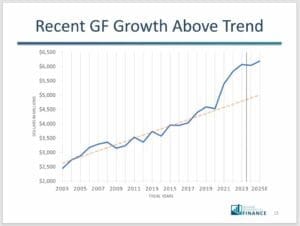

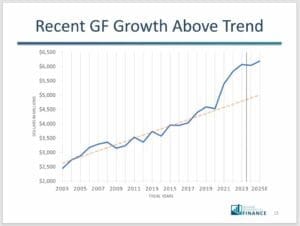

Revenue growth trends

Even so, said State Rep. Danny Short, R-Seaford, the best news out of Monday’s meeting of the Delaware Economic Forecast and Advisory Council is that the state’s financial position improved between its October and December meetings.

“It’s a good picture to have a revenue increase when, in fact, a lot of folks were anticipating a recession not too many months ago,” said Short, who is a member of the council. “It looks like we’re not going to have that, hopefully. Knock on wood.”

The council’s prediction added $89 million to the forecast of $6.6 billion in revenues for FY2025, which starts July 1.

It seems to reflect a growing belief that the nation will avoid a recession, a feeling bolstered by a recent announcement that the Federal Reserve Board has no plans to raise interest rates again and may begin to lower them next year.

If the U.S. does indeed have what many term “a soft landing,” it will be the first time in history that inflation has risen to 5% or more and the country hasn’t gone into a recession, the committee said.

Delaware finance experts said they expect Delaware’s revenues to plateau and perhaps meet the upward trend in a couple of years.

Short, who has been in the General Assembly for 18 years, said he would like to see the state do the same kind of analysis of its expenditures as it does revenues.

“We need to have a clearer picture of what we are spending money on and what it is we can control,” he said. “What are the items that we are unable to control?”

The state must meet contractual obligations such as union contracts and other fixed costs he called “door openers” but he said he’s not sure what else is in the state’s expenditures.

“It’s time we tried to determine what it is we can do to lessen the cost that we have,” he said. “If you were in business, you would be looking at what is my expense and what is it I can control and what is I can maybe reduce. We’re not doing that.”

Knowing more about expenditures will benefit the next governor, no matter who it is, Short said.

Gov. Jack Markell, who served from 2009 to 2017, entered office with a $400 million budget deficit. Gov. John Carney, who leaves office in January 2025, entered his first term with an $800 million deficit, Short pointed out.

“As we continue to spend every dollar we’ve got, that burdens that administration coming in with the ability or inability, depending on which it is, to meet those obligations,” said Short.

“You don’t want to dip into your savings to pay things that are regular expenses because that will diminish your reserve and diminish the ability down the road, if you have a huge dip, to be able to make sure you can afford to continue without major tax increase to the public.”

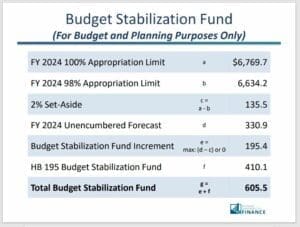

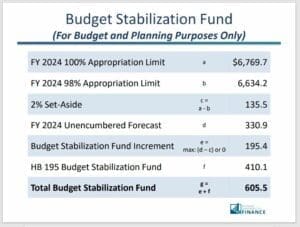

Delaware’s budget stabilization fund, which is designed as a savings account to help in years when the economy hurts the state budget, is well funded.

He’s a fan of the budget stabilization fund created by Carney through executive order. It requires the state to put a portion of the state revenue into the fund each year for use in times of financial trouble.

The state turned to that fund in 2020 after the COVID-19 pandemic shredded state revenues to help fill out its next fiscal year budget.

The stabilization fund now has $60 million in it, according to DEFAC records.

Short said no one can predict now if the next governor will keep the council or the fund, which was part of the discussion Monday.

IN THE NEWS: A proposed bill would expand access to medical marijuana

It’s not common for an incoming governor to rescind the executive order of a previous governor, said Secretary of Finance Rick Geisenberger.

The fund, however, has proven popular with both Republicans and Democrats. It originally was the idea of former State Treasurer Ken Simpler.

When a bill creating it couldn’t make it through the General Assembly, Carney created it through executive order.

Betsy Price is a Wilmington freelance writer who has 40 years of experience.

Share this Post