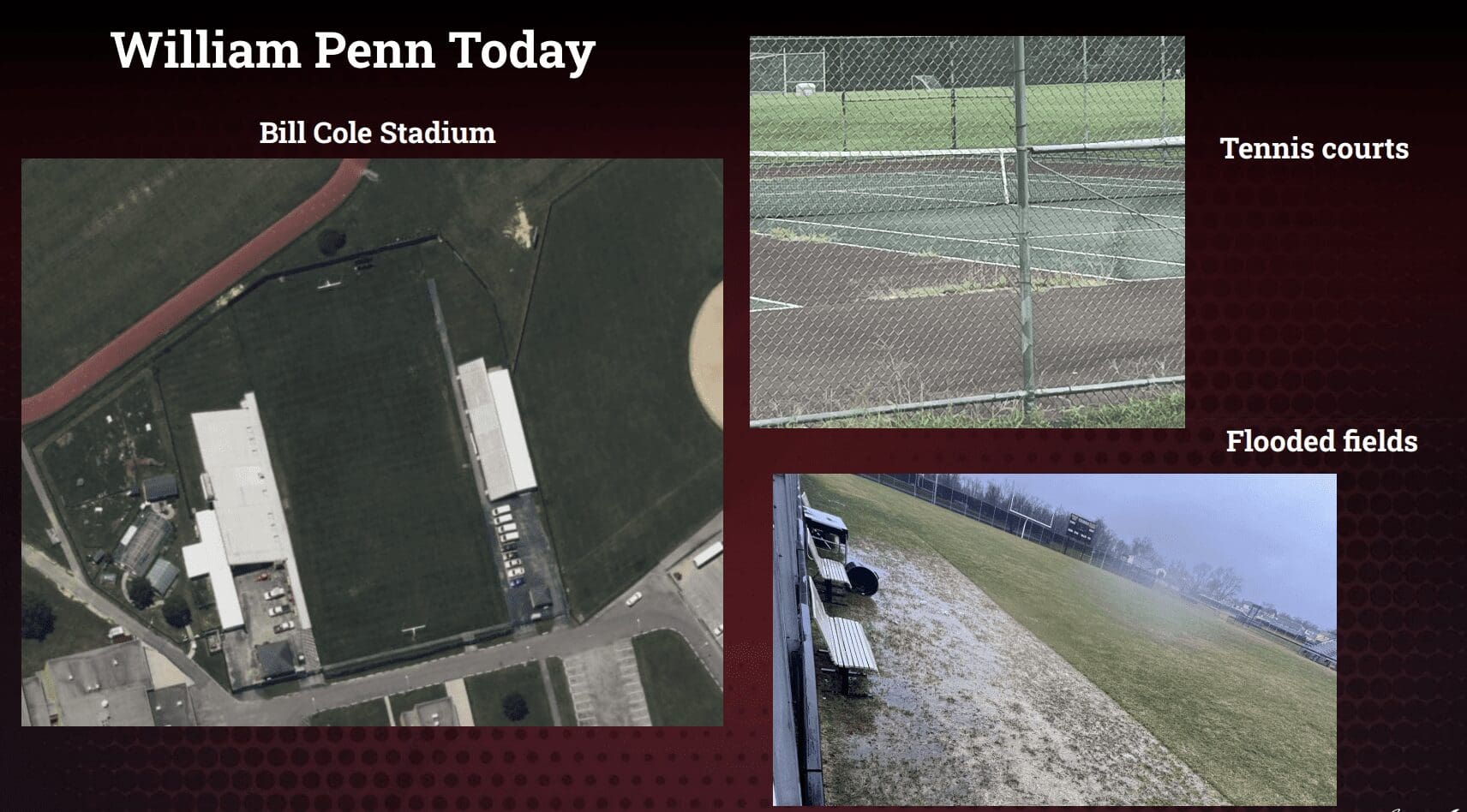

Colonial is looking to upgrade and renovate its athletic facilities, which can be utilized by the community.

How Colonial School District sports will benefit from a $61 million tax referendum was a common theme among questions during Wednesday’s virtual public forum.

District officials fielded queries about the effect of the referendum, which would raise average homeowners taxes by about $250 annually.

The money will be used to match state funds of $122 million for maintenance and improvements on all of the district’s 13 school buildings, which is 60% of the cost.

The district’s residents must approve the tax hike via referendum to cover the 40% of the local portion, or it loses the state certificate of necessity funding.

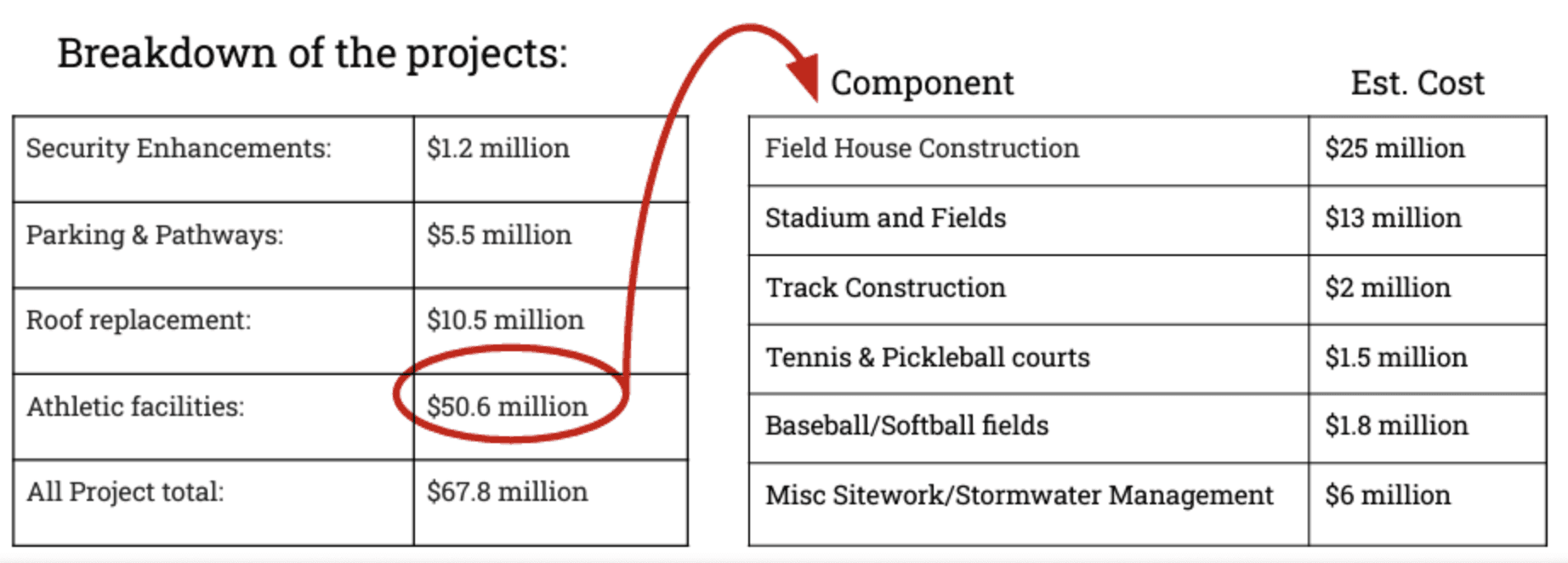

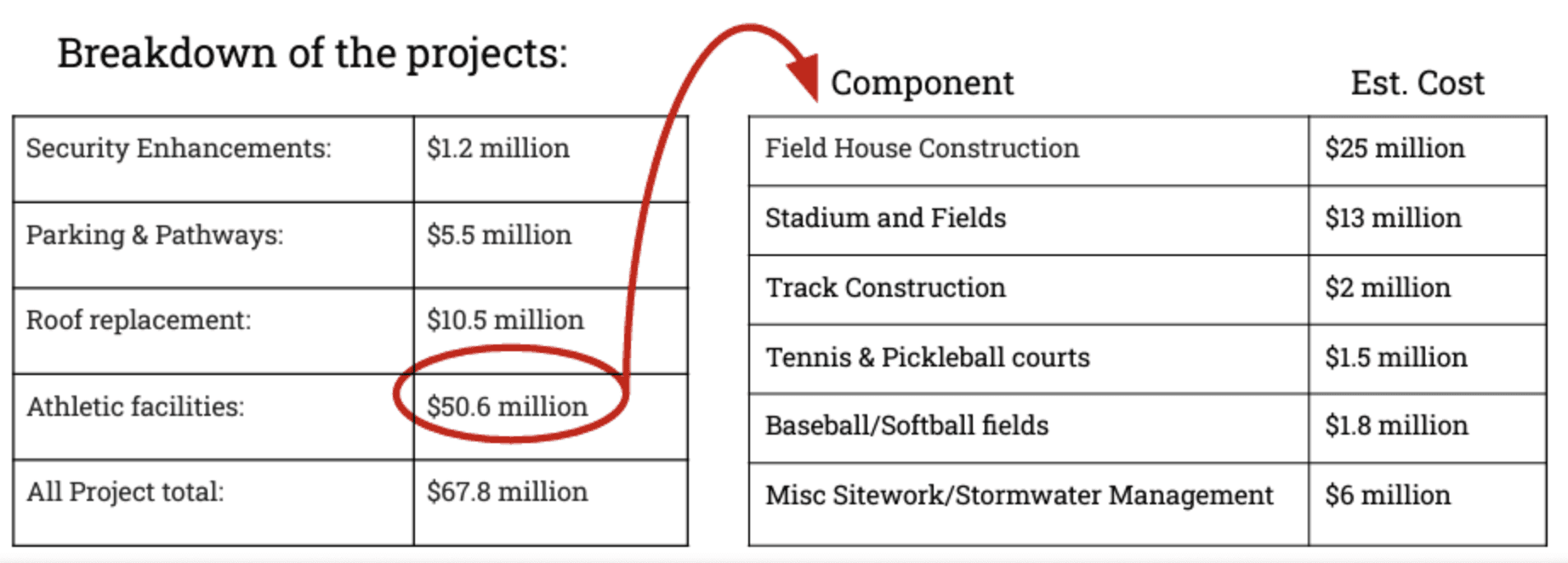

Colonial Superintendent Jeff Menzer called athletic spending the “highest ticket item” of the capital needs, estimated to cost $50.6 million is allotted to sports upgrades:

“We’re not hiding that fact, but what’s really important is every student at every level deserves access to that,” he said. “We’re in a space now in our high schools across the state, private, public, parochial, it doesn’t matter… we’re looking at facilities that our students and families deserve.”

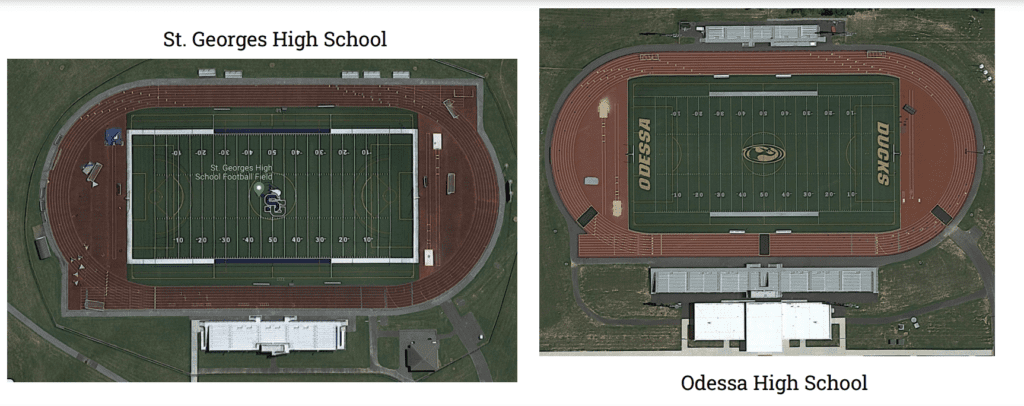

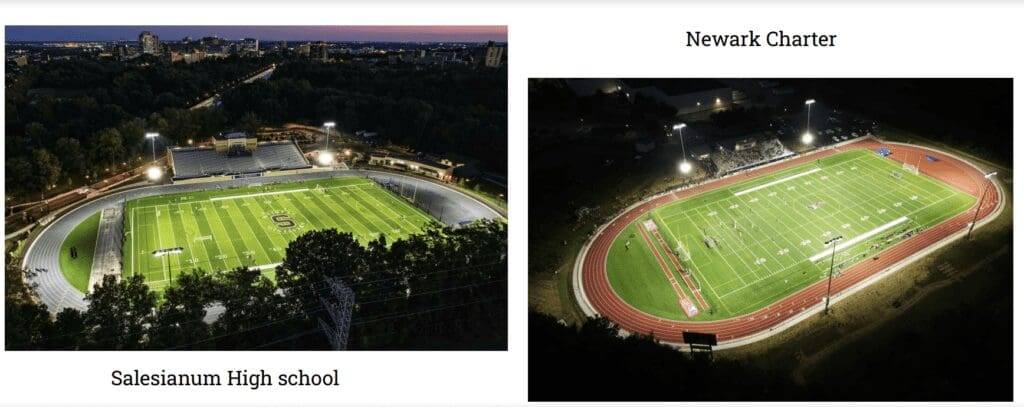

He cited some notable sports facilities in New Castle County, such as the ones at the Charter School of Wilmington, Appoquinimink High School, Odessa High School, and Abessinio Stadium at Salesianum School.

Lauren Wilson, the district’s public information officer, added that when the sports facilities were in good shape, they were a resource for people who aren’t even Colonial students.

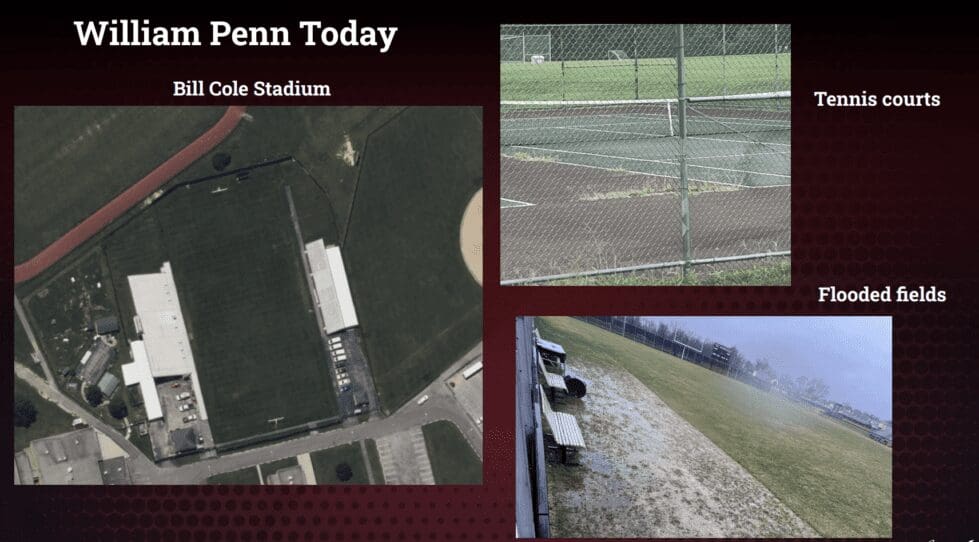

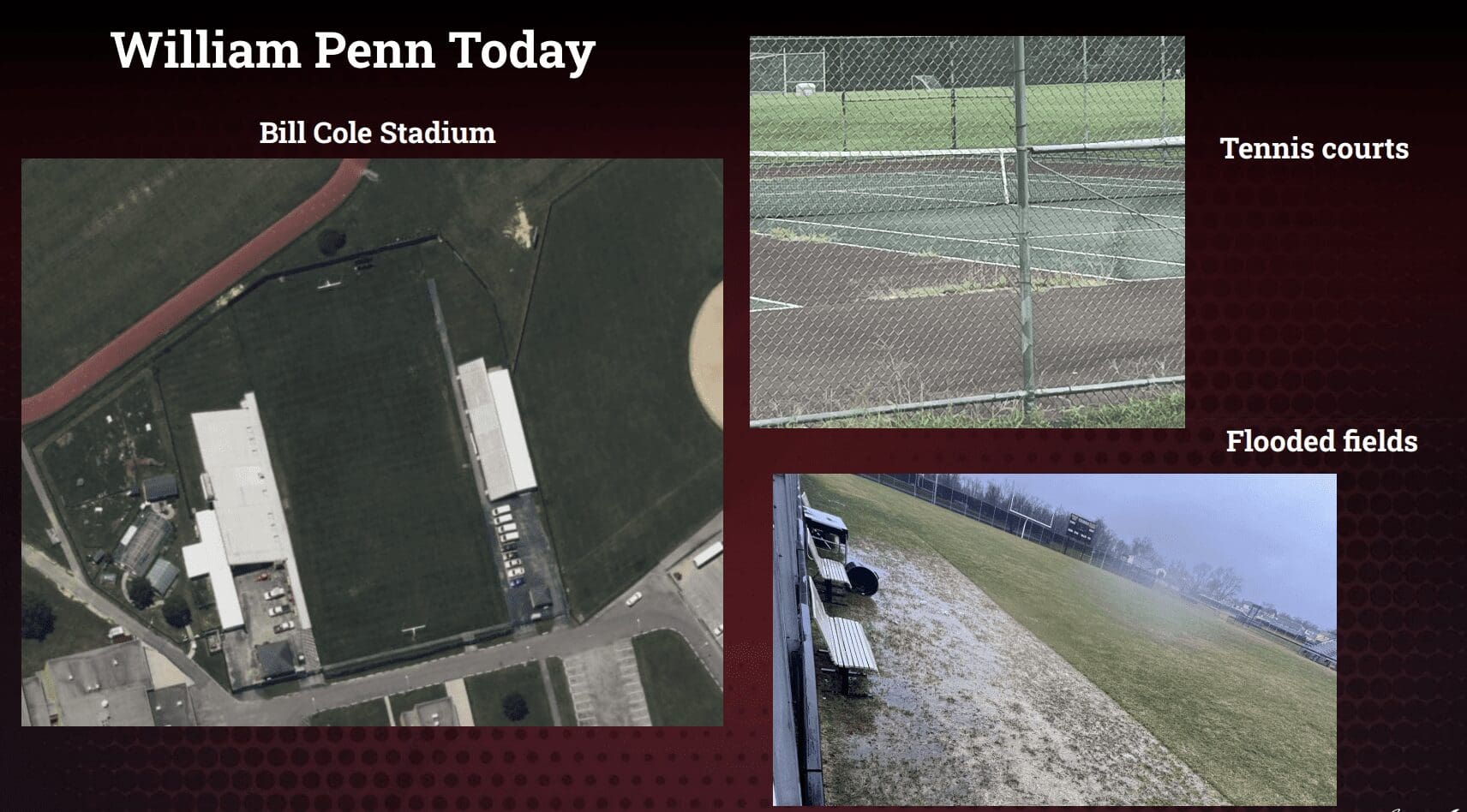

“There was a time when community members were using the tennis courts at William Penn, there was a time when you would see people walking around the middle school tracks,” she said. “They just don’t do that anymore because they aren’t suitable for anyone to use, and so everyone will benefit from the upgrades to the stadium at William Penn.”

If older residents, people with mobility issues or people with disabilities want to attend a game now, she said, it’s not an easy task because of the condition of the stadiums and the way the parking is configured.

“These are the improvements that can be embraced by the community,” she said. “We’re talking about pickleball courts – that’s a big thing now and that’s something we want our community to come and utilize our facilities and take some pride in the facilities that we have.”

Gabriel Phillips, Colonial’s strategic marketing officer, pointed to unplayable tennis courts and fields that are easily flooded.

“We are behind the times because our kids go away when they go to a game … They’re going away to places like Odessa, places like St. Georges and they’re seeing these really awesome facilities and they come home and they see our facilities that haven’t been updated,” he said.

He also pointed out that the sports program is a source of pride for Colonial students and families, and the athletic facilities should reflect that.

Colonial’s referendum is Thursday, Feb. 29, with polls open from 7 a.m. to 8 p.m.

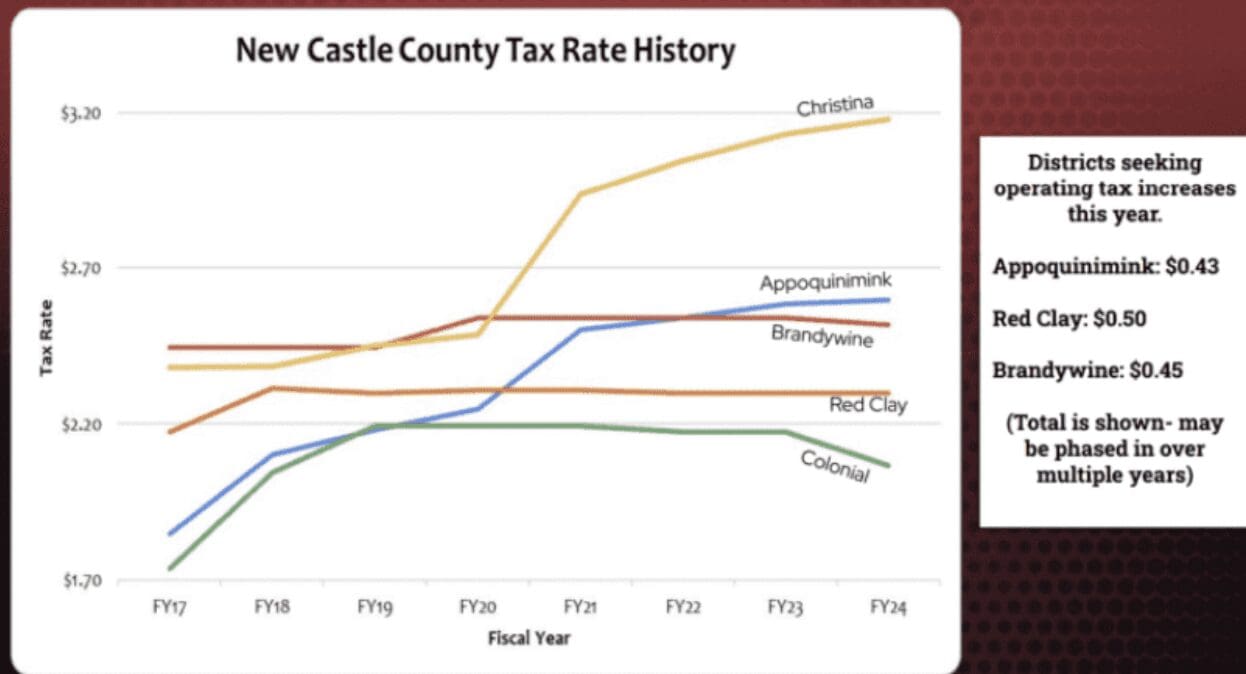

The district, which has the lowest tax rate in New Castle County, is one of five going to referendum this year to try to increase local revenue and get state-matching funds.

RELATED: 5 school districts to hold tax hike referenda in 2024

It will have another in-person referendum forum Tuesday, Feb. 13 at 5:30 p.m. at William Penn High School.

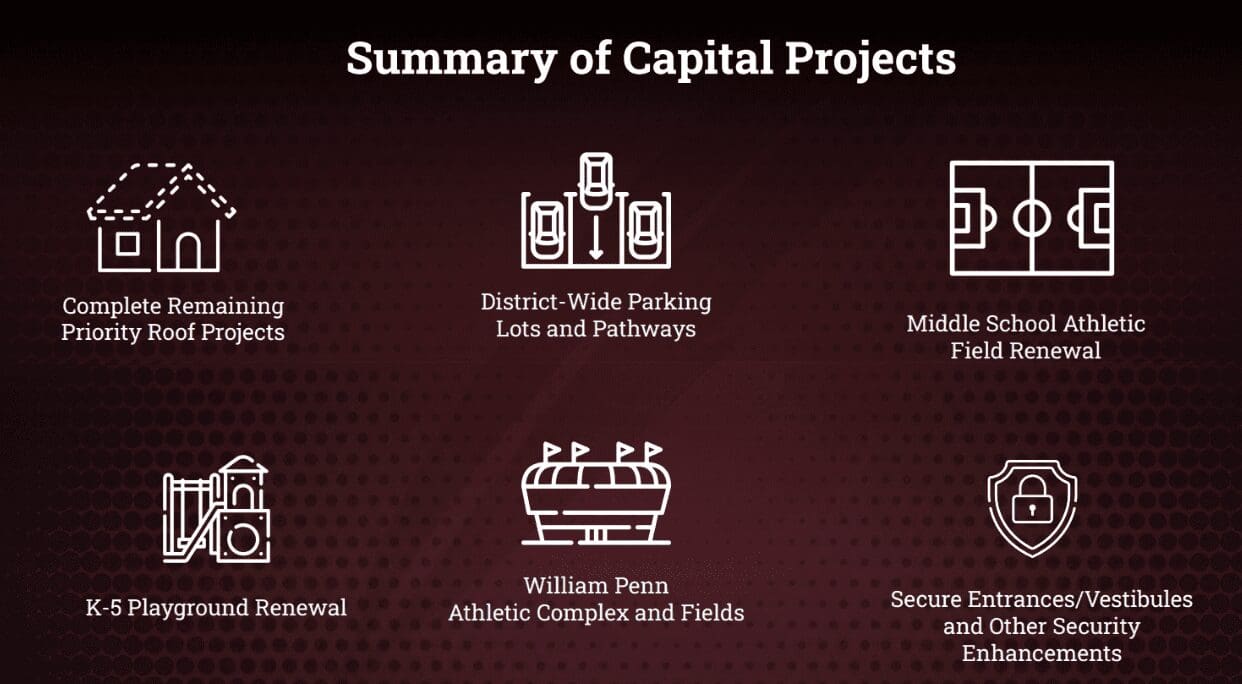

Here’s a look at more details about where the tax money will go.

Colonial forum details proposed tax hike, reassessment effect

Originally published Jan. 10

A Colonial School District forum Tuesday about a vote to raise school tax revenue by $61 million also served to ease fears about the effects of property reassessments.

“Everyone thinks that ‘Oh my god, my house is gone from this and it’s quadrupled, my taxes are going to skyrocket’, and that would be true except we have to reset the rate backwards,” said Emily Falcon, Colonial’s chief financial officer.

That means that if the property values quadruples, the school tax rate would be cut by a fourth, since the district must remain revenue neutral.

“We can’t get any more money after reassessment than we’re getting right now,” Falcon said, “Unless the school board chooses to take that little bit extra that they’re allowed to under Delaware law.”

That “little bit extra” is up to a 10% increase in the district’s local revenue. So if the revenue is $50 million, the maximum revenue increase would be an extra $5 million, which would be reflected in the tax rate and spread out among district residents.

The district’s school board would have to vote on whether or not to raise the local revenue, but it is not obligated to do that or to raise it 10%. It can choose a smaller amount.

Falcon said she has no clue whether the board would vote on an increase.

The board is more than a year away from needing to make that decision, as both New Castle and Sussex counties are expected to have its reassessments completed by July 2025, so the new tax rate would go into effect in fiscal year 2026, which starts in July 2025.

Delaware’s three counties have not been reassessed in decades.

New Castle properties have not been reassessed since 1983, Falcon said.

“Properties built after 1983 are still assessed based on what their home would have been worth in 1983,” she said. “So a home built in 2023 gets backwards math to determine what it would have cost if it was on the books in 1983.”

Kent County’s reassessment is done, and residents have already received letters detailing their new property values.

RELATED: Kent County residents first to see new property values

Kent County will have $14.5 million in local revenue, and since property values went up about 600%, the county tax rate is being adjusted from 36 cents per $100 of assessed property value to about 6 cents per $100 of assessed property value – again, to remain revenue neutral, which is required the first year after the assessments take effect.

Tuesday’s meeting also reiterated the details of Colonial’s Feb. 29 referendum, in which the ballot will contain two questions, whether or not to support a tax hike for operational needs, and the same for capital project needs.

Colonial is asking residents to vote for $48.8 million to address capital needs, and $12.6 million for operational needs.

If Colonial’s referendum passes, there will be a phased approach to a local tax increase, with a spike of 25 cents per $100 of assessed property value in fiscal year 2025, 10 cents in fiscal year 2026 and five cents in fiscal year 2027.

The average annual increase to a Colonial taxpayer would be about $250.

“Our tax rate is currently $2.066 cents, so you’re getting charged $2.066 on every $100 of assessed value that your home has and that calculation is what leads to our local revenue,” Falcon said.

“I do think it’s important to again note that among the districts in New Castle County, Colonial currently has the lowest tax rate,” Falcon said.

She pointed out that Appo’s referendum just failed weeks ago, and Brandywine and Red Clay also have referendums in February.

RELATED: Appo referendum fails, preliminary voting results show

In addition to a slew of other resources to help inform residents, Colonial has an online calculator that homeowners can use to figure out the tax increase specific to their property.

The Department of Education approved a $122 million certificate of necessity for maintenance and improvements on all 13 district school buildings.

The state/local split is 60%/40%, meaning the state provides 60% of the funding ($73.2 million) and the district is on the hook for the remaining 40% ($48.8 million).

If the referendum fails, Colonial can hold one more referendum, but if it fails again, the district loses all $73.2 million in state funding.

The average building in Colonial is 60 years old, so the capital portion of the referendum is focused on updating and improving district facilities.

The operating portion of the referendum is staffing and program cuts, since the district had an operating deficit of $5.7 million in fiscal year 2023 and is projected to have a deficit of $7.7 million in fiscal year 2024.

Below is a recap of the referendum ask.

Colonial details Feb. 29 referendum to raise revenue

Originally published Dec. 13, 2023

Colonial School District is the latest to detail an operating and capital referendum to be held early next year.

In the district’s school board meeting Tuesday night, the board voted a phased approach to a local tax increase, with a spike of 25 cents per $100 of assessed property value in fiscal year 2025, 10 cents in fiscal year 2026 and five cents in fiscal year 2027.

This will result in more revenue for the district, which is meant to combat an expected operating budget deficit of $8 million this fiscal year and provide local funds for the operational needs and construction projects within the district.

The board had two other options that would generate revenue quicker, but would increase taxes more in a short amount of time.

They had an option that would bump up taxes 40 cents per $100 of assessed property value in fiscal year 2025, but the board opted for a phased approach to be put on the ballot.

Board member Robin Crossan was one of two board members to vote against this option. He preferred putting the 40 cent increase on the ballot to get revenue and thwart the operating deficit as soon as possible.

Colonial’s referendum will take place Feb. 29, 2024.

Its last referendum was in spring 2017.

“It failed in February and we went out for a second time in June and it passed,” Superintendent Jeff Menzer said.

The Department of Education recently approved a $122 million certificate of necessity for maintenance and improvements on all of the district’s 13 school buildings, which is 60% of the cost.

RELATED: Colonial, Red Clay biggest winners in state funding requests

The local/state split is different for every district, but usually is around 65% state/35% district.

Emily Falcon, the district’s chief financial officer, said that the average age of Colonial’s school buildings is 60 years old.

With the average Colonial household assessed value set at $62,547, the average district resident will have Annual impact for the average household is $250.19

In addition to maintenance to the school buildings, the bump in revenue would help the district upgrade and renovate the parking lots, roofs, ADA accessible playgrounds, sidewalks, athletic facilities and lighting installments to sports fields.

Red Clay and Brandywine are also going holding referendums in February.

Appoquinimink narrowly failed to pass their referendum requests in Tuesday’s vote.

RELATED: Appo referendum fails, preliminary voting results show

At the long-awaited funding report release event Tuesday, speakers cited one of the problems with the current funding formula in Delaware is it puts too much pressure on districts and residents to raise local funds in order to fulfill the needs of the neighborhood schools.

RELATED: Adding $500M+ more into education likely matter for legislature

Falcon also cited that Colonial’s tax hike is less than the other New Castle County districts holding a referendum:

Colonial’s last referendum was in spring 2017.

“It failed in February and we went out for a second time in June and it passed,” Superintendent Jeff Menzer said.

The district’s referendum will take place Feb. 29, 2024.

Raised in Doylestown, Pennsylvania, Jarek earned a B.A. in journalism and a B.A. in political science from Temple University in 2021. After running CNN’s Michael Smerconish’s YouTube channel, Jarek became a reporter for the Bucks County Herald before joining Delaware LIVE News.

Jarek can be reached by email at [email protected] or by phone at (215) 450-9982. Follow him on Twitter @jarekrutz and on LinkedIn

Share this Post