The Caesar Rodney School District wants to raise district school taxes by 27.7% over three years to help pay for utilities, maintenance, building budgets and staffing.

It’s taking that request to voters in a referendum April 22. Caesar Rodney’s last referendum was in 2015.

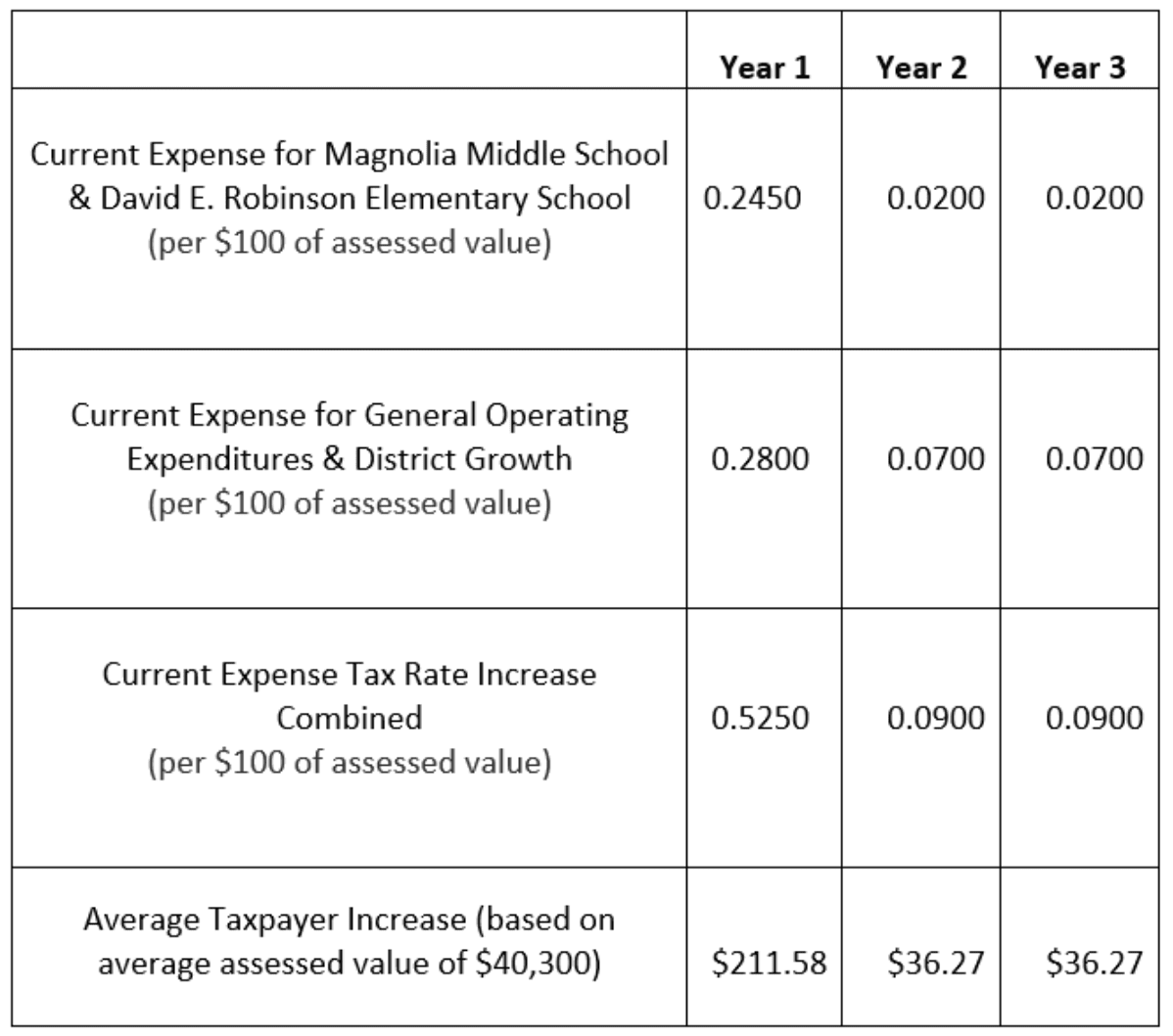

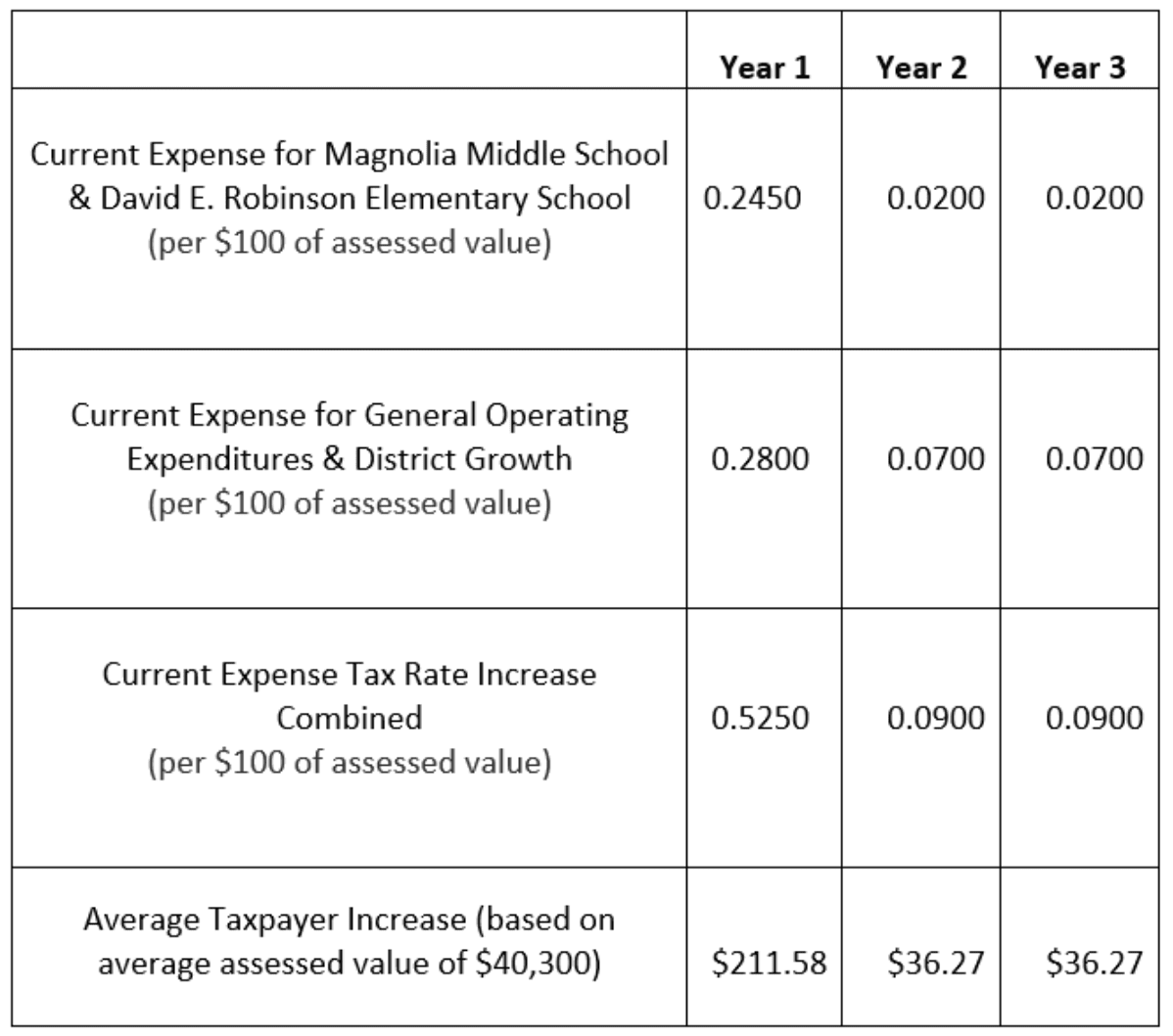

The average taxpayer, who owns a house with an assessed value of $40,300, would have their taxes increased by $211.58 in 2024 and another $36.11 in 2025 and 2026, said Caesar Rodney Superintendent Christine Alois.

Alois said the district’s expenses are outpacing its revenue and it must raise taxes to get an $11,037,200 state Certificate of Necessity grant.

Under the terms of that grant, the district has to raise $4,508,152 for a total of $15,545,352.

The grant will fund a heating, ventilation, and air conditioning system for Magnolia Middle School; operating costs for David E. Robinson Elementary School and Magnolia Middle School, both of which opened in 2022 without operating budgets; and general operating expenditures related to district growth.

The grant also requires voters to approve the grant’s expenditures.

If the public voted against the tax increases, Caesar Rodney would not receive any of the $11,037,200 state share.

Because the ballot will have three questions on it, one related to each of the areas to be funded, it’s possible voters could approve one or two projects, without approving the third.

Voting for the heating, ventilation and air conditioning project will not increase taxes at all, Alois said.

Voting for operating expenses for the David Robinson and Magnolia schools would increase tax rates of 0.245 cents in year one, 0.02 cents in year two and 0.02 cents in year three for each $100 of assessed home value, Alois said.

Voting for general operating expenditures related to district growth would have an increase in tax rates of 0.28 cents in year one, 0.09 cents in year two and 0.09 cents in year three – again, per $100 of assessed home value.

The third element of the referendum would raise funds to help the district maintain and expand programs presented in the 2022-2027 Strategic Plan.

The plan seeks to ensure the district maintains a 1:1 device-to-student ratio and help it support the local portion of funding for staffing and capital improvements.

Voting will take place on Saturday, April 22, from 7 a.m. to 8 p.m.

Voting locations include Allen Frear Elementary School, W. Reily Brown Elementary School, Fred Fifer III Middle School and J. Ralph McIlvaine Early Childhood Center.

A referendum allows residents of a school district, through a ballot process, to vote to approve or reject changes to the district operating expense tax and debt service tax.

“Generally, districts need to increase local property taxes when the districts’ local expenses out-pace the local property tax revenues,” said John Marinucci, executive director of the Delaware School Boards Association.

He pointed out that inflation has increased dramatically in the past two years, causing significant increases in everything from food, utilities, educational supplies, custodial supplies, employee health care benefits and more.

“Most districts have found themselves in a situation where they need to cut program expenses or increase local property tax revenues, or some combination of both, in order to balance their budgets,” he said.

Alois acknowledged that the district’s expenses are outpacing its revenue.

“It’s just the increasing costs since now we’re incurring growth as a district,” Alois said. “We’ve had a significant growth in positions within the district for a variety of needs, which include our constables, behavioral health specialists, teachers, para-professionals, and we’ve also increased our transportation operation as well.”

Caesar Rodney enrolls 8,290 students, which is 324 more students than the district had in 2021.

The district’s school board voted unanimously in its Feb. 28 meeting to approve the referendum.

Magnolia’s HVAC system

The school has a 25-year-old heating-and-air-conditioning system that needs to be replaced.

The district can fund the local portion of $2,933,900 in new bonds at no increase to the current major capital tax rate.

“We need to go out and ask the public if they would be willing, at no additional cost to their current tax rate, to approve that piece of certificate of necessity,” Alois said.

Public meetings

Alois will present information on the tax referendum at three public meeting, all starting at 6 p.m.:

- Wednesday, March 29 at Allen Frear Elementary School

- Tuesday, April 4 at W. Reily Brown Elementary School

- Wednesday, April 5 at Caesar Rodney High School

The April 5 meeting will also be livestreamed

For more information on Caesar Rodney’s referendum, including frequently asked questions and tax information, click here.

Raised in Doylestown, Pennsylvania, Jarek earned a B.A. in journalism and a B.A. in political science from Temple University in 2021. After running CNN’s Michael Smerconish’s YouTube channel, Jarek became a reporter for the Bucks County Herald before joining Delaware LIVE News.

Jarek can be reached by email at [email protected] or by phone at (215) 450-9982. Follow him on Twitter @jarekrutz and on LinkedIn

Share this Post